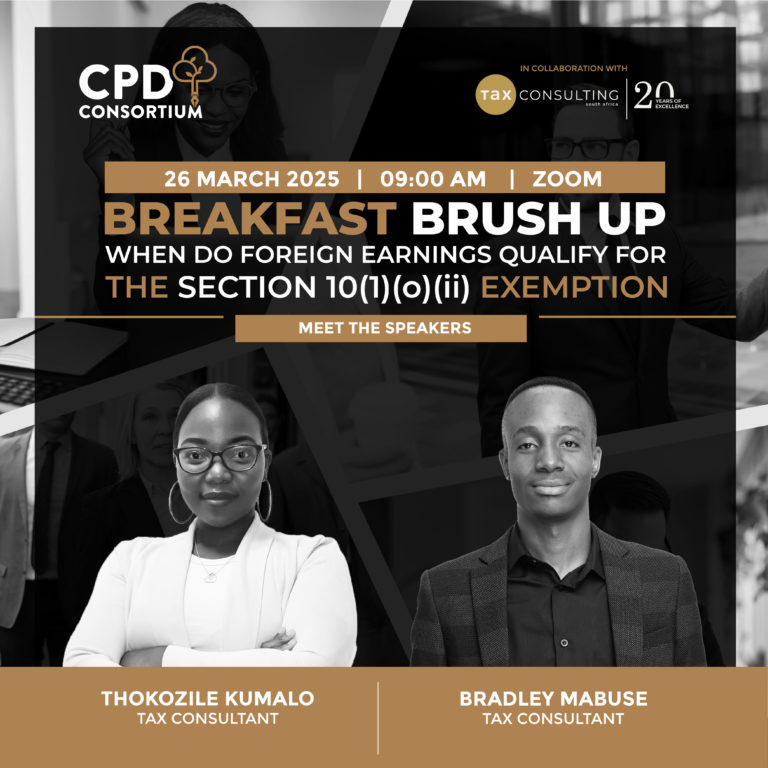

Breakfast Brush Up

When Do Foreign Earnings Qualify for the Section 10(1)(o)(ii) Exemption?

26 MARCH 2025

09:00 – 09:45am

R90.00

FREE to Subscribers

ZOOM

Whether you are a tax practitioner with clients who are South African residents working abroad, or someone looking to expand your knowledge on key aspects of cross-border tax issues, join us for a comprehensive session on the Section 10(i)(o)(ii) exemption.

*0.5 CPD Points Available

Register today to understand the Section 10(i)(o)(ii) exemption and how it applies to South Africans working abroad.

This session will cover the key aspects of the Section 10(1)(o)(ii) exemption, focusing on who qualifies and when. It will address common pitfalls and misconceptions around the application of the exemption, as well as the serious consequences of non-compliance. Whether advising clients or expanding your tax knowledge, this session provides the practical insights needed to navigate this complex area of expatriate taxation.

Key topics include:

- Eligibility for the Section 10(i)(o)(ii) Exemption – Who qualifies for the Section 10(i)(o)(ii) exemption and the key requirements South African residents working abroad must meet to ensure they are eligible for the exemption.

- Understanding the Days Requirement for Qualification – How the days spent working abroad are calculated and how to ensure clients meet the required threshold for the exemption.

- Common Misunderstandings – Addressing frequent misconceptions and mistakes made by both tax practitioners and individuals regarding the exemption, helping avoid costly errors.

- Practical Compliance Tips – Guidance on ensuring compliance with proper documentation and filing, helping minimise risks and meet tax obligations.

- Consequences of Non-compliance – Highlighting the potential penalties and tax liabilities of non-compliance, with advice on how to avoid these risks.

Who Should Attend?

- Tax practitioners working with South African residents living and working abroad.

- Individuals seeking to understand the tax implications of working abroad and the Section 10(i)(o)(ii) exemption.

- Professionals interested in enhancing their knowledge of cross-border tax issues and compliance.

- Those responsible for managing tax returns or advising clients on South African tax matters related to overseas work.

REGISTRATION IS CLOSED

Whether you’re advising clients or enhancing your own knowledge. Register now to secure your spot:

EVENT STARTS IN:

MEET THE SPEAKERS

Bradley

Mabuse

TAX CONSULTANT

Bradley Mabuse is a Tax Consultant at Tax Consulting South Africa, having started his tax career in 2021. A registered Tax Technician with the South African Institute of Taxation (SAIT), Bradley specialises in expatriate taxation, corporate tax, and individual tax matters. He is committed to expanding his expertise and is currently pursuing a postgraduate qualification to obtain the Tax Advisor designation, alongside further studies in accounting. Bradley provides clients with effective tax solutions, with a particular focus on individual tax planning and compliance.

Thokozile Kumalo

TAX CONSULTANT

Thokozile Kumalo is a Tax Consultant at Tax Consulting South Africa, specialising in Individual Tax Returns and Tax Return Services. A registered Tax Technician Practitioner (TTP) with the South African Institute of Taxation (SAIT), Thokozile holds a Bachelor of Accounting degree from the University of Johannesburg. Since starting her tax career in 2021, she has developed strong expertise in Trusts, Deceased Estates, and Individual Taxation, gained through her previous role at Standard Trust Limited. Thokozile’s focus is on delivering clear tax solutions for individuals, ensuring compliance with regulations and addressing complex tax matters. Committed to professional growth, she has earned a Professional Certificate in Estates and Trust Administration and continues to expand her knowledge in taxation.