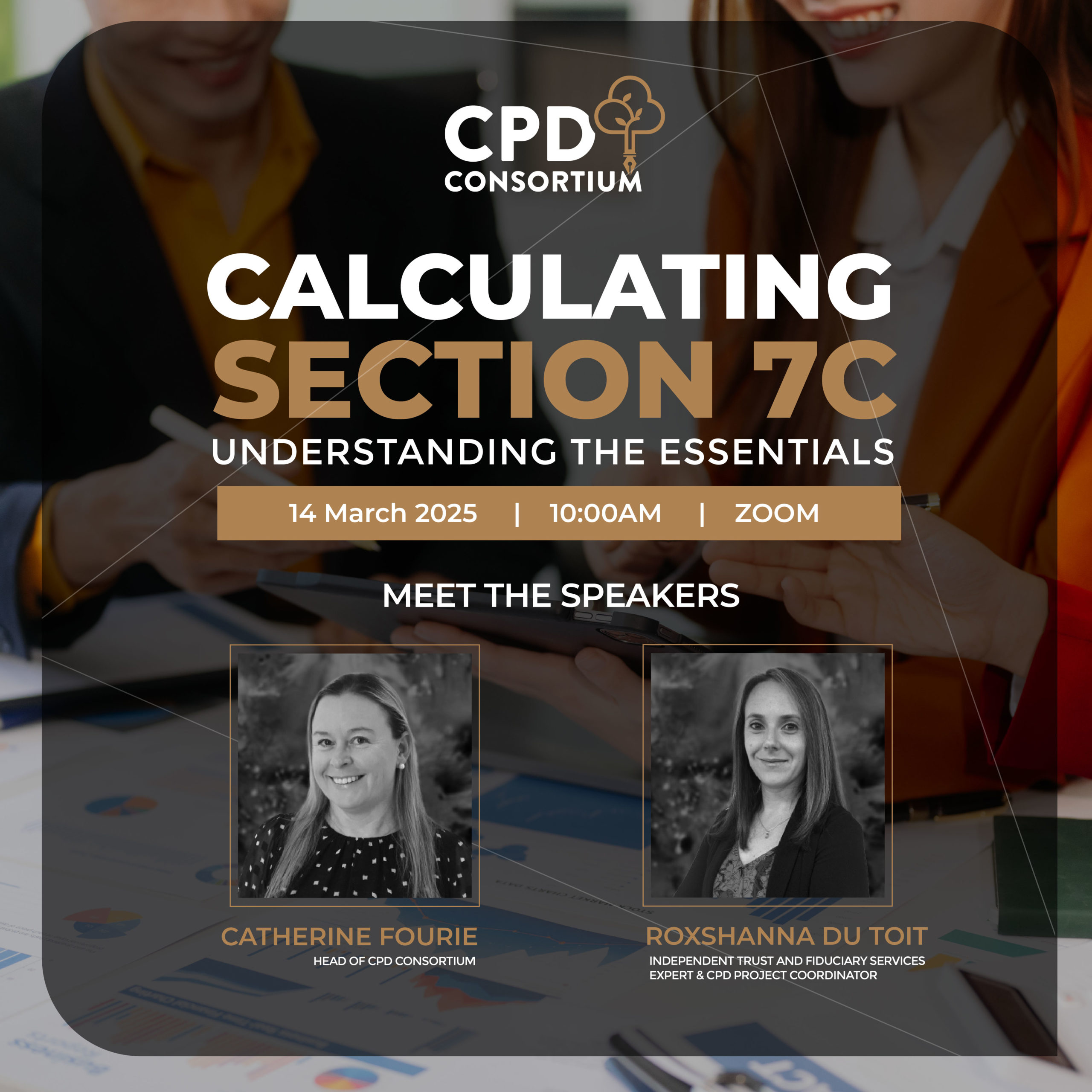

Calculating Section 7C:

Understanding the Essentials

14 MARCH 2025

10:00 – 11:00am

R180.00

FREE to Subscribers

ZOOM

February marks the end of the tax year for Resident Trusts and brings the s7C deemed donation into sharp focus. s7C of the Income Tax Act requires the calculation of a deemed donation in respect of low interest loans by connected persons to Trusts, which is payable by the month following the year end of the trust.

In addition, an amendment to the Act effective 1 January 2025 and effective for years of assessment commencing on or after that date has the effect that a loan, advance or credit which is subject to the transfer pricing rules in s31 of the Act may still be subject to a deemed donation under s7C.

Loans to Trusts have important and far-reaching tax consequences, especially when those loans are at a low interest rate or do not bear interest.

Join us for this vital session – register now!

Key Topics

- Principles of s7C: Loan, advance or credit granted to a trust by connected person.

- Practical example: calculating the donations tax arising, including completion of the new IT144 declaration by donor form with reference to the SARS external guide updated on 21 February 2025.

- Overview recent amendment to s7C with reference to s31 with a practical example.

- Recap of the attribution rules under s7 and the Eighth Schedule (CGT) in the case of continuous donations.

- Q&A and discussion session.

Who Should Attend?

- Tax Practitioner, Tax Consultant or Tax Advisor

- Trustee, founder or lender to a trust

- Trust administrator or Trust officer

- Trust Accountant or Bookkeeper

REGISTRATION IS CLOSED

EVENT STARTS IN:

MEET THE SPEAKERS

Catherine

Fourie

HEAD OF CPD CONSORTIUM

Catherine is a Chartered Accountant (CA(SA)) and tax practitioner who completed her articles at Deloitte in 2003. After three secondments to the United States of America and Canada, she rejoined Deloitte as audit manager for four years, whereafter she has been a lecturer on the BCom Accounting programme with the Nelson Mandela University for 15 years until early 2024. Her main subjects were Taxation, Auditing and Ethics and Corporate Governance, as well as lecturing on the MCom (Taxation) program.

She has a deep passion for teaching to which she has dedicated most of her professional career, especially fundamental principles. She implemented innovative learning and teaching practices, both online and hybrid/flexible; always ensuring impactful learning. As a member of the SAICA Digital Acumen Working Group she has always been passionate about innovation and resilience, which are both essential for the sustainability and growth of the modern professional. With the many students which have been through her lectures, she is excited to now bring digital innovation to the upskilling of professionals who work in the ever-changing landscape of tax and accounting. Her approach and style is one of ensuring a sound technical base, from where she quickly makes tax and accounting highly practical and relevant; delivering immediate value for anyone attending her training sessions.

Roxshanna du Toit

Independent Trust and Fiduciary Services Expert & CPD Project Coordinator

Roxshanna is a seasoned tax professional and was until February 2024 the Head of Tax, Standard Trust Limited. As one of the market’s largest leading fiduciary services providers, she worked daily on complex matters pertaining to tax and accounting for trusts, deceased estates and the commercial and family interests which necessarily comes therewith. She has a BCom (Taxation Honours) and also served as a lead representative for the Banking Association of South Africa (BASA) in providing input to SARS directly as impacts the fiduciary arena. Her interest sphere is streamlined solutions to overcome the administrative and operational challenges of trustees, accountants, tax practitioners and executors. She considers herself as a practical generalist who excels in getting the job done, and she has been involved in untangling, resolving and ensuring compliance of some of the largest and most complex South African and international trusts, estates and family structures. Her decision to start her own practice allows her to expand her professional horizon as well as spend more quality time with her son.