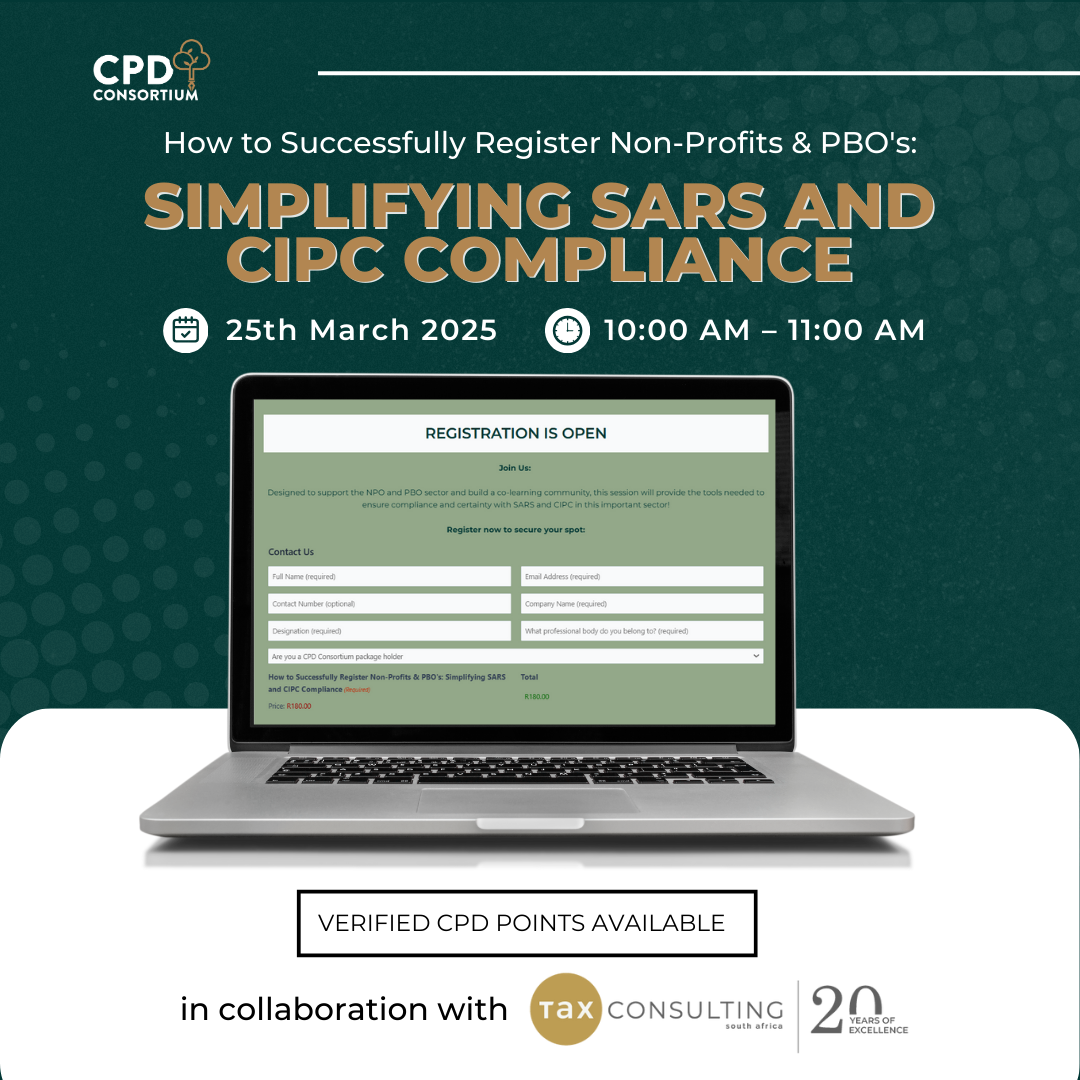

IN COLLABORATION WITH

How to Successfully Register

Non-Profits & PBO's:

Simplifying SARS and CIPC Compliance

25 MARCH 2025

10:00am – 11:00am

R180.00

FREE to Subscribers

ZOOM

Compliance in the non-profit sector is essential, but navigating the requirements can often feel complex and overwhelming. Non-profit organisations, including Public Benefit Organisations (PBOs), play a critical role in serving the public interest, yet the registration process with both SARS and the Companies and Intellectual Property Commission (CIPC) can be tricky.

Join us for this session, where we unpack the registration requirements with both SARS and CIPC for these important entities that serve the public interest, and provide practical insights into managing the full compliance process for non-profits and PBOs and ongoing obligations with SARS and CIPC.

*1 CPD Point Available

Engage with industry experts – Reserve your spot now!

In this session, you’ll gain practical knowledge on the following key topics:

- Understanding the different entities that can serve as vehicles in the non-profit and public benefit sector.

- Critical considerations with CIPC when registering a non-profit company, ensuring all legal requirements are met.

- Navigating the registration with SARS, including how to complete the Application for Exemption from Income Tax Form (El1), with a focus on the new SARS guide issued on 2 December 2024.

- When does a non-profit qualify as a Public Benefit Organisation (PBO)? Learn the key criteria for classification and tax-exempt status.

- Exploring Section 18A deductions for donations to qualifying organisations, plus other important tax considerations.

- Key SARS reporting requirements, including how to manage third-party IT3(d) reporting and ensure proper compliance.

- SARS resources and guidance available to assist you through the registration and compliance processes.

- Interactive Q&A session to address your specific challenges and provide tailored advice.

Who Should Attend?

- Tax Practitioners and Tax Professionals

- NPO and PBO Founders, Trustees, Board Members, and Administrators

- Compliance Officers for NPOs and PBOs

- Financial Managers and Accountants in the non-profit sector

- Legal Advisors and Consultants specialising in non-profit law

- Fundraisers and Development Officers working with NPOs/PBOs

- Governance Consultants and Advisors for NPOs and PBOs

- Auditors (Internal/External) for non-profit organisations

- Non-profit Sector Consultants with expertise in NPO/PBO operations

REGISTRATION IS CLOSED

Join Us:

Designed to support the NPO and PBO sector and build a co-learning community, this session will provide the tools needed to ensure compliance and certainty with SARS and CIPC in this important sector!

EVENT STARTS IN:

MEET THE SPEAKERS

Catherine

Fourie

Head of CPD Consortium

Catherine Fourie is a Chartered Accountant (CA(SA)) and tax practitioner who completed her articles at Deloitte in 2003. After three secondments to the United States of America and Canada, she rejoined Deloitte as audit manager for four years, whereafter she has been a lecturer on the BCom Accounting programme with the Nelson Mandela University for 15 years until early 2024. Her main subjects were Taxation, Auditing and Ethics and Corporate Governance, as well as lecturing on the MCom (Taxation) program. She has a deep passion for teaching to which she has dedicated most of her professional career, especially fundamental principles. She implemented innovative learning and teaching practices, both online and hybrid/flexible; always ensuring impactful learning. As a member of the SAICA Digital Acumen Working Group she has always been passionate about innovation and resilience, which are both essential for the sustainability and growth of the modern professional.

Tasneem

Pandor

CIPC Secretary

Tasneem Pandor is the CIPC Secretary at Tax Consulting South Africa. She is currently completing her BCom degree in Financial Management, specialising in compliance within companies with the CIPC. Tasneem ensures that her clients adhere to all statutory requirements. Her role involves handling various compliance matters, including beneficial ownership submissions, share certificates, and Public Officer appointments. Tasneem’s expertise extends to navigating legal and administrative requirements, making her an invaluable asset to her clients. Tasneem is committed to continuous learning and development in her field, striving to provide the highest level of service to her clients.