EVENT STARTS IN:

Lunchbox Session: IT3(d) Reporting

What You Need to Know Before 31 May 2025

16 May 2025

12:30 pm to 13:30 pm

FREE

ZOOM

1 CPD POINT AVAILABLE

IT3(d) reporting is now in its third filing season, and many Public Benefit Organisations (PBOs) are still navigating the complexities of compliance. With the next deadline fast approaching on 31 May 2025, this free update session is essential for anyone involved in IT3(d) submissions.

The training includes understanding the following:

Which entities are required to submit IT3(d) data to SARS

What information must be included in the submission

How the submission process works and what SARS submission platforms can be used

What the implications may be for donors and PBO’s if submissions are not made correctly or on time

Who Should Attend?

- Tax Practitioners and Tax Consultants

- Accountants and Auditors

- Business Compliance Officers

- PBO Treasurers

- PBO Administrators

- PBO Trustees

Join this free Lunchbox session and use your lunch hour to refresh your knowledge of IT3(d) reporting ahead of the 31 May 2025 submission deadline.

#IT3(d)Reporting #TaxReporting #TaxCompliance #SARS #PBO’s #TaxAlert #ReportingInsights

REGISTRATION IS CLOSED

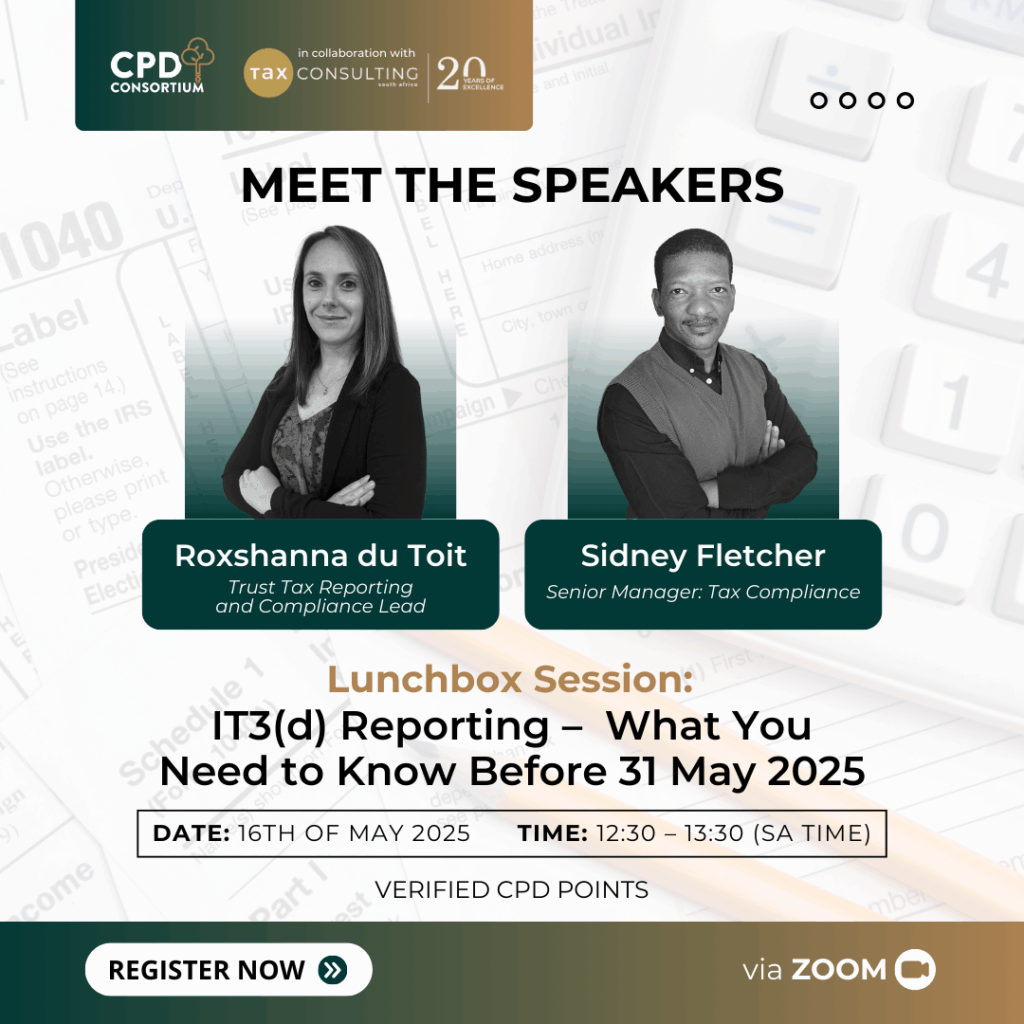

MEET THE PRESENTERS

Roxshanna du Toit

Trust Reporting and Compliance Lead

READ MORE

Roxshanna is a seasoned tax professional and was until February 2024 the Head of Tax, Standard Trust Limited. As one of the market’s largest leading fiduciary services providers, she worked daily on complex matters pertaining to tax and accounting for trusts, deceased estates and the commercial and family interests which necessarily comes therewith. She has a BCom (Taxation Honours) and also served as a lead representative for the Banking Association of South Africa (BASA) in providing input to SARS directly as impacts the fiduciary arena. Her interest sphere is streamlined solutions to overcome the administrative and operational challenges of trustees, accountants, tax practitioners and executors. She considers herself as a practical generalist who excels in getting the job done, and she has been involved in untangling, resolving and ensuring compliance of some of the largest and most complex South African and international trusts, estates and family structures. Her decision to start her own practice allows her to expand her professional horizon as well as spend more quality time with her son.

Sidney Fletcher

Senior Manager: Tax Compliance

READ MORE

Sidney is a versatile and results-driven qualified Tax Technician and Senior Tax Practitioner. With over 20 years of experience in the tax environment, with a significant portion spent at SARS specialising in Taxpayer Education and the Tax Administration of Trust and Deceased Estates, He brings a wealth of expertise to his role as Senior Manager Trust and Deceased Estates Tax Compliance. Sidney is a dedicated professional with extensive knowledge, particularly in Individual and Trust Taxes which makes him an outstanding tax planner adept at tax optimisation. He enjoys the subtle nuances and complexities of tax, finding them both challenging and stimulating. Committed to providing the best care for his clients through transparent communication, Sidney is also skilled in negotiation and possesses a strong ability to problem-solve to assist clients with any tax-related issues they may encounter.