EVENT STARTS IN:

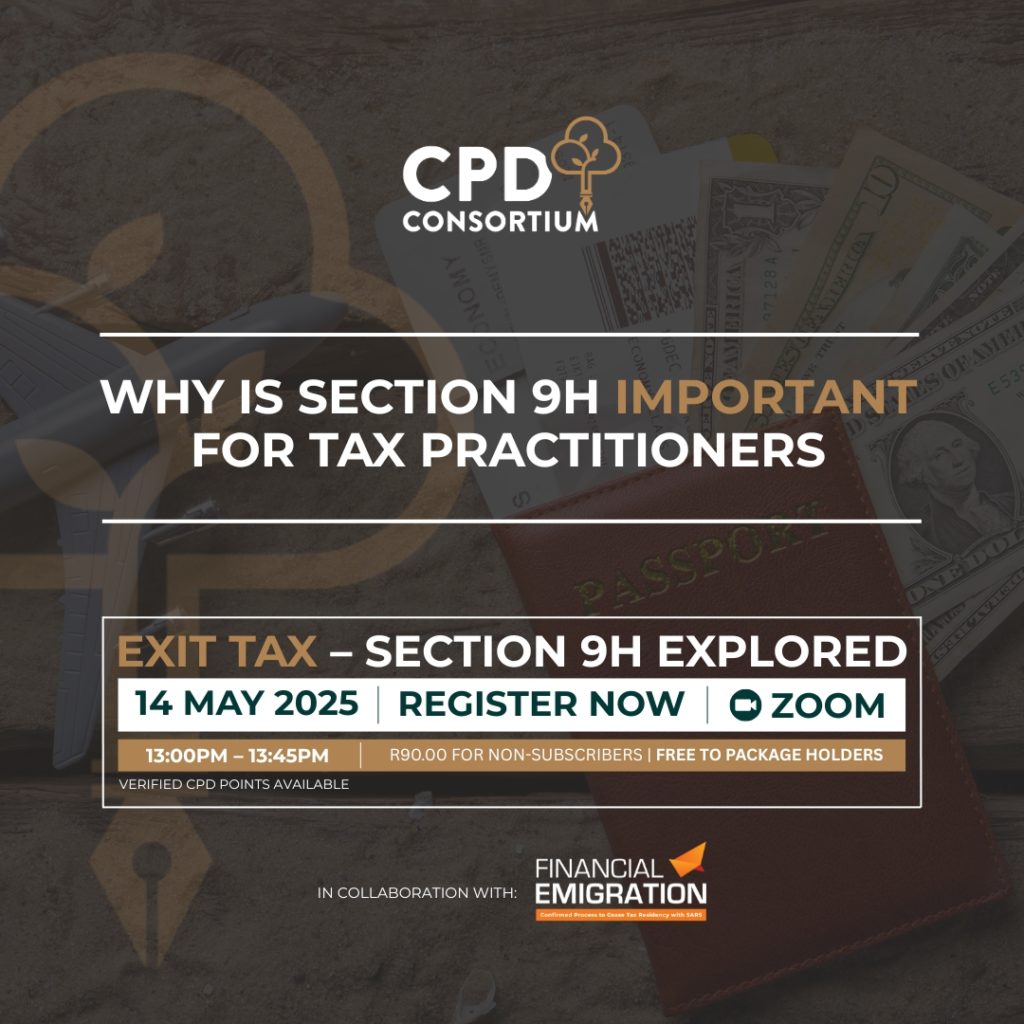

EXIT TAX

Section 9H Explored

14 May 2025

13:00pm – 13:45pm

R90.00 for non-subscribers

Free to package holders

ZOOM

0.5 CPD POINTS

AVAILABLE

For tax practitioners, accountants, and professional advisors assisting clients with tax emigration, understanding the complexities of Section 9H of the Income Tax Act is essential. This webinar will provide an in-depth review of the legal and tax implications surrounding the cessation of tax residency, focusing on key considerations, compliance requirements, and potential challenges.

Gain expert insights into how exit tax applies, the concept of deemed disposal, and best practices for managing tax obligations when ceasing South African tax residency. This session will equip professionals with the tools needed to guide clients through this intricate process and mitigate potential tax risks.

0.5 CPD Points Available

In this session, the following key topics will be covered followed by a 15-minute Q&A session:

Understanding the Criteria for Ceasing Tax Residency

- Key provisions under Section 9H and their implications.

Understanding the Deemed Disposal Rule

- The impact of capital gains tax on assets when ceasing residency.

Compliance & Reporting Requirements

- Ensuring accurate declarations and meeting SARS obligations

Ceasing Residency Common Challenges

- Addressing practical issues that arise during the exit tax process

Who Should Attend?

- Tax Practitioners & Accountants – Assisting clients with tax emigration and SARS compliance

- Financial Advisors & Wealth Managers – Advising on tax-efficient financial planning for expatriates

- Legal & Immigration Consultants – Navigating cross-border tax regulations and residency implications

Do not miss this essential session for professionals advising clients on tax residency cessation. Register today to gain expert insights and practical solutions for managing Section 9H exit tax effectively.

#Taxandbenefits #Workshop #InteractiveLearning #ExpertQandA #JoinTheConversation

REGISTRATION IS CLOSED

MEET THE PRESENTER

Nicolas Botha

Tax Team Compliance & Processing Manager

READ MORE

Nicolas Botha, Tax Compliance & Processing Manager, brings extensive expertise in expatriate tax compliance, with a focus on South African tax residency and individual income tax profile analysis. His daily interactions with SARS have honed his deep understanding of their requirements and technical processes, particularly in the context of South Africans working abroad.